Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter ( TTY ), call 1-800-926-9105.

This toolkit explains Canada’s Old Age Security (OAS) program and its benefits, which include the Old Age Security pension, the Guaranteed Income Supplement, the Allowance and the Allowance for the Survivor. The toolkit will help you find out if you are eligible for these benefits and how to apply. Use On this page to help you browse and see how the toolkit is organized.

The OAS program includes:

The OAS pension: A monthly taxable benefit for seniors aged 65 and older who meet the Canadian legal status and residence requirements. The Guaranteed Income Supplement (GIS): A monthly non-taxable benefit for OAS pension recipients who have a low income and are living in Canada. The Allowance: A monthly non-taxable benefit for low-income individuals aged 60 to 64 whose spouse or common-law partner receives the GIS. The Allowance for the Survivor: A monthly non-taxable benefit for individuals aged 60 to 64 who have a low income, who are living in Canada, and whose spouse or common-law partner has died.

To receive CPP or QPP, you must have worked and contributed to either plan. You can receive OAS benefits even if you have not worked in Canada.

You can use the eligibility maps to determine potential eligibility for the OAS pension and the GIS. There is 1 map for each benefit.

Follow the questions step-by-step, answering yes or no to each.

After using the maps, if you are still unsure whether you're eligible, we recommend you apply anyway, or contact Service Canada (go to Section 4.1) for additional information on your particular situation.

After you complete the eligibility maps, you can go to Section 2.2 or Section 2.3 to find out:

Eligibility result:

You are likely eligible! Go to Section 1.3 to find out if you are eligible for the GIS.

Required documents:

Eligibility result:

You are likely eligible! Go to Section 1.3 to find out if you are eligible for the GIS.

Required documents:

Eligibility result:

Depending on Canada’s agreement with this country, you may be eligible to receive the OAS pension Footnote 3 . Go to Section 1.3 to see if you are also eligible for the GIS.

Required documents:

Eligibility result:

You do not appear to be eligible for the OAS pension because you have not:

However, you may be eligible in the future if you live in Canada for the minimum number of years (go to Section 1.2).

Eligibility result:

You are likely eligible! Go to Section 1.3 to find out if you are also eligible for the GIS.

Required documents:

Eligibility result:

You are likely eligible! Go to Section 1.3 to find out if you are also eligible for the GIS.

Required documents:

Eligibility result:

You do not appear to be eligible for the OAS pension because you do not have legal status in Canada. However, you may be eligible in the future, if you obtain legal status (go to Section 1.2).

Eligibility result:

Depending on Canada’s agreement with this country, you may be eligible to receive the OAS pension.

Required documents:

Eligibility result:

You do not appear to be eligible for the OAS pension because you have not:

However, you may be eligible in the future if you live in Canada for the minimum required number of years (go to Section 1.2).

Eligibility result:

You are likely eligible! Go to Section 1.3 to find out if you are also eligible for the GIS.

Required documents:

Eligibility result:

Depending on Canada’s agreement with this country, you may be eligible to receive the OAS pension Footnote 3 .

Required documentation:

Eligibility result:

You do not appear to be eligible for the OAS pension because you have not:

However, you may be eligible in the future if you live in Canada for the minimum required number of years (go to Section 1.2).

Eligibility result:

You are likely eligible! Go to Section 1.3 to find out if you are also eligible for the GIS.

Required documents:

Eligibility result:

Depending on Canada’s agreement with this country, you may be eligible to receive the OAS pension Footnote 3 .

Required documents:

Eligibility result:

You do not appear to be eligible for the OAS pension because you have not:

However, you may be eligible in the future if you live in Canada for the minimum number of years (go to Section 1.2).

Eligibility result:

You do not appear to be eligible for the OAS pension because you do not have legal status in Canada. However, you may be eligible for the OAS pension if you had legal status before leaving Canada.

Eligibility result:

You are not eligible for the OAS because you are under 64 years of age. However, you may be eligible for the Allowance (go to Section 1.4) or the Allowance for the Survivor (go to Section 1.5).

Eligibility result:

You are likely eligible for the GIS as long as you live in Canada. Go to Section 2.2 for information on applying for both the OAS pension and the GIS. If you are already receiving the OAS pension but have not applied for the GIS, go to Section 2.3 for information on applying for the GIS only.

Required documents:

Eligibility result:

You do not appear to be eligible for the GIS at this time because your combined net annual income is above the maximum amount Footnote 8 . To see more detail on the maximum net annual income amounts for GIS eligibility, please refer to Section 4.3. These maximums may increase annually with the cost of living.

Eligibility result:

You are likely eligible for the GIS as long as you live in Canada. Go to Section 2.2 for information on applying for both the OAS pension and the GIS. If you are already receiving OAS pension but have not applied for the GIS, go to Section 2.3 for information on applying for the GIS only.

Required documents:

Proof of marital status: If you are married, you must provide an original or certified copy of your marriage certificate. If you are in a common-law relationship, please provide a statutory declaration of your union and another proof of the relationship.

Eligibility result:

You do not appear to be eligible for the GIS at this time because your combined net annual income is above the maximum amount Footnote 8 . To see more detail on the maximum net annual income amounts for GIS eligibility, please refer to Section 4.3. These maximums may increase annually with the cost of living.

Eligibility result:

You are likely eligible for the GIS as long as you live in Canada. Go to Section 2.2 for information on applying for both the OAS pension and the GIS. If you are already receiving the OAS pension but have not applied for the GIS, go to Section 2.3 for information on applying for the GIS only.

Eligibility result:

You do not appear to be eligible for the GIS at this time because your combined net annual income is above the maximum amount Footnote 8 . To see more detail on the maximum net annual income amounts for GIS eligibility, please refer to Section 4.3. These maximums may increase annually with the cost of living.

Eligibility result:

You must be eligible for the OAS pension in order to receive the GIS. Confirm your eligibility using the OAS eligibility map in Section 1.1.

To be eligible for an OAS pension, you must:

If you are applying from outside Canada, you must have:

To determine if you qualify for the OAS pension, go through the OAS pension eligibility map in Section 1.1 then find out how to apply in Section 4.3.

Note: If you have lived or worked in a country with which Canada has a social security agreement, you may still qualify to receive the OAS pension even if you have not lived in Canada for the required number of years. Go to the OAS pension: Partial pension under Section 1.2 for more information.

Note: If you are 64 years old, live in Canada and have paid into the Canada Pension Plan or Quebec Pension Plan program for 40 years or more, you may receive a letter from Service Canada notifying you that you will be automatically enrolled for the OAS pension. Go to Section 2.1 for more information.

Omar has lived in Canada all of his life. Doris was born in Portugal and has lived in Canada for a total of 8 years.

Sonia works for an organization that assists seniors. She knows that Omar and Doris are both eligible for the OAS pension, Omar for a full pension and Doris for a partial pension.

Because Omar was born in Canada and has lived here all his life, next year when he turns 65 he can receive a full OAS pension.

Doris has lived in Canada 8 years. Her time in Portugal can be counted to meet the 10-year residence requirements for the OAS pension. At 65, she will receive a partial pension.

Generally, you can qualify for a full OAS pension (the maximum benefit amount) if you have lived in Canada for at least 40 years after the age of 18.

In some situations you may qualify for a full OAS pension without having 40 years of residence. (for example, if you were 25 or older and lived in Canada or had a valid Canadian immigration visa on or before July 1, 1977).

If you do not qualify for a full OAS pension, you may qualify for a partial pension.

If you live in Canada when you apply, you can receive a partial OAS pension if you have lived in Canada for at least 10 years after the age of 18. If you live outside of Canada when you apply, you can receive a partial OAS pension if you have lived in Canada for at least 20 years after the age of 18.

A partial monthly pension is earned at the rate of 1/40th of the full monthly pension for each year of residence in Canada after the age of 18. For example, if you have lived in Canada for 27 years after the age of 18, you will receive 27/40ths of the full monthly pension amount. Once a partial pension has been approved, it will not increase with additional years of residence in Canada.

In some cases, you may qualify for the OAS pension even if you have not lived in Canada for the minimum number of years. Please refer to the OAS pension: Partial pension under Section 1.2 for more information.

Your Canadian residence is simply periods when you ordinarily make Canada your home.

When determining your periods of residence in Canada, periods of absence from Canada may also be considered in some circumstances. This may also be the case for your spouse, common-law partner or dependents.

If you worked outside Canada for a Canadian employer such as the Canadian Armed Forces or for an international charitable organization, it is possible to have your time working abroad count as residence in Canada.

For time outside of Canada to count as residence in Canada, you must have:

*You will need to provide proof of employment from the employer and proof of your return to Canada.

Doris was born in Portugal and has lived in Canada for 8 years. Due to Canada’s agreement with Portugal, she can use 2 years of her time spent in Portugal to meet the 10 year minimum residence requirement for the OAS pension. As a result, Doris receives 8/40ths of a full OAS pension.

Sonia thinks Doris may be eligible for a foreign benefit based on Canada's agreement with Portugal. The agreement allows Doris to use time she spent in Portugal to qualify for the OAS pension, and her time spent in Canada to qualify for a benefit from Portugal. Doris can learn more about Canada’s agreement with Portugal from the Service Canada website or by calling Service Canada.

If you currently live in Canada, you may qualify for the OAS pension even if you have not lived in Canada for 10 years after the age of 18.

If you currently live outside Canada, you may qualify for the OAS pension even if you have not lived in Canada for 20 years after the age of 18.

Canada currently has social security agreements with nearly 60 countries. These agreements allow your time living and contributing in another country to be counted as residence in Canada. They can help you qualify for both the OAS pension and for foreign benefits.

For example, if at age 65 you have lived or worked at least 2 years in a country with which Canada has an agreement, you may meet the 10-year residence requirement for the OAS pension by using the 2 years you spent in the other country. If you are eligible, your OAS pension amount is calculated at the rate of 1/40th of a full pension for each year of residence in Canada after the age of 18. As a result, you would receive 8/40ths of a full OAS pension. You would not receive credit for the 2 years you lived outside of Canada.

Note: Some agreements may limit the periods that can count toward the OAS pension. For more information about Canada's social security agreements with other countries, go to Section 4.3.

Hugo is 65 years old and has lived in Canada for 27 years. This means he is eligible for 27/40ths of a full pension. He could choose to start receiving his OAS pension the month after his 65th birthday.

Hugo decides to receive his OAS pension as soon as he is eligible because he could use the additional money each month.

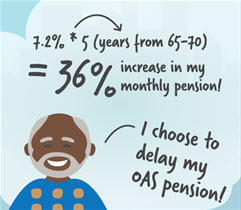

Omar is eligible for a full OAS pension. He could choose to start receiving his OAS pension the month after his 65th birthday. However, he doesn't think he needs the money yet. Omar can delay his pension start date. If he chooses to delay his pension, the amount will increase by 0.6% for every month of the delay for a maximum of 60 months. For example, if Omar delays until age 70, his OAS pension amount will increase by 36% for the rest of his life.

Omar chooses to delay his OAS pension. For each year that Omar delays receiving his OAS pension, the amount increases by 7.2% per year until he reaches the age of 70. At age 70 his pension would increase by 36% total (from $718.33 to $976.93 monthly, based on July 2024 OAS rates). Omar must notify Service Canada in writing as soon as possible.

Your OAS pension can start as early as the month following your 65th birthday or the month after you meet the minimum residence and legal status requirements.

You can choose to delay receiving your OAS pension payment up to the age of 70. By doing this, you increase the amount of your benefit. For each month you wait to start your OAS pension, your pension amount will go up by 0.6%. This means it will go up by 7.2% per year or 36% over 5 years. For example, a pension of $718.33 per month at age 65 would be $976.93 per month at age 70. However, you must advise us in writing no later than 6 months following your 65th birthday.

| Age | When do you want your OAS to start | Monthly amount you could receive |

|---|---|---|

| 65 | If you don't delay receipt of your OAS | $718.33 |

| 66 | 12 months x 0.6% = 7.2% | $770.05 |

| 67 | 24 months x 0.6% = 14.4% | $821.77 |

| 68 | 36 months x 0.6% = 21.6% | $873.49 |

| 69 | 48 months x 0.6% = 28.8% | $925.21 |

| 70 | 60 months x 0.6% = 36% | $976.93 |

To decide when you want to start receiving your OAS pension, think about:

Note: If your net annual income exceeds a certain amount ($86,912 for 2023), you may have to repay part of your entire OAS pension. Your OAS pension would be reduced as a monthly recovery tax.

Note: If you delay your OAS pension, you will not be eligible for the GIS during that time and, if applicable, your spouse/common-law partner will not be eligible for the Allowance during that time. Also, the GIS does not increase when you delay the OAS pension.

Note: You must notify Service Canada as soon as possible if you choose to delay the start date of your OAS pension. This can be done in writing up to 6 months after your 65th birthday.

The OAS pension is reviewed in January, April, July and October to reflect increases in the cost of living and OAS monthly payment amounts may increased accordingly. Should the cost-of-living decrease, OAS payment amounts will remain the same.

Starting in July 2022, seniors will see an automatic 10% increase of their OAS pension the month after they turned 75 years old. Pensioners who have already reached 75 years of age by July 2022 will also see an automatic 10% increase of their OAS pension.

Maggie is applying for the OAS pension. She lives in Canada and has almost no other income. Sonia thinks she may be eligible for the GIS.

Sonia reminds Maggie that once she starts receiving the GIS, if she leaves the country for more than 6 months, her GIS payment will stop. Also, Maggie must file her taxes on time every year, to ensure that her payment of the GIS is renewed.

The GIS is an additional monthly payment for seniors living on a low income. It is not taxable.

To be eligible for the GIS, you must:

You may start receiving the GIS as early as you start receiving your OAS pension. The GIS amount you receive depends on your annual net income or, in the case of a couple, the combined income of you and your spouse/common-law partner. Your GIS amount may change each year depending on your income.

The GIS amount is reviewed in January, April, July and October to reflect increases in the cost of living and GIS monthly payment amounts are increased accordingly. Should the cost-of-living decrease, GIS payment amounts will remain the same as long as you remain eligible.

Note: If you leave Canada for more than 6 months, your GIS payment will stop no matter how long you previously lived in Canada. You must contact Service Canada upon your return in order to have your entitlement to GIS reviewed.

If you apply for the GIS, Service Canada will review your account each year to see if you are still eligible and receiving the right amount. It is very important that you file an income tax return on time every year.

To see if you qualify, go through the GIS eligibility map in Section 1.1 then find out how to apply in Section 4.3.

Starting in July 2020, if you are employed or self-employed and receive the GIS, you can earn up to $5,000 and still receive the full GIS amount. For earnings between $5,000 and $15,000 your GIS will be reduced by 50 cents for every dollar of income you receive.

Service Canada will calculate the earnings exemption for you upon receiving your income information and that of your spouse or common-law partner when you file your taxes with the CRA or by completing a Statement of Income form.

If you qualify for the OAS pension through the terms of a social security agreement, you may also receive the GIS.

You may receive a partial GIS (1/10th of the full GIS amount) for each year you have lived in Canada after the age of 18. Your GIS amount will be increased for each additional year you live in Canada (up to a full GIS amount at 10 years).

Note: If you entered Canada as a sponsored immigrant, you cannot receive the GIS while under a sponsorship agreement unless your sponsor:

Stuart is 60 years old and married to Maggie. Maggie is 65 years old and receives both the OAS pension and the GIS. Stuart has legal status in Canada and has lived in Canada for more than 10 years since the age of 18.

Sonia determines that Stuart may be eligible for the Allowance. She reminds Stuart that once he starts receiving the Allowance, if he or Maggie leave Canada for more than 6 months, his Allowance payment and her GIS payment will be stopped. Sonia also explains that the Allowance will no longer be paid once Stuart turns 65 years old and becomes eligible for the OAS pension.

The Allowance is a monthly benefit for individuals aged 60 to 64 whose spouse or common-law partner receives the OAS pension and the GIS. Payment of the Allowance stops when the person receiving it reaches their 65th birthday (the age of eligibility for the OAS pension and the GIS).

To be eligible for the Allowance, you must:

The Allowance amount you receive depends on the combined income of you and your spouse/common law partner. Your Allowance amount may change each year depending on your income.

*If you have not lived in Canada long enough, a social security agreement may help you to qualify (go to Section 1.2).

Note: If you or your spouse or common-law partner leave Canada for more than 6 months, your Allowance payment will stop no matter how long you previously lived in Canada. You must contact Service Canada upon your return in order to determine your entitlement to ALW reviewed.

To apply for the Allowance, go to Section 4.3.

Mary is age 62, living on a low income and her spouse has died.

Mary has not remarried or entered into a common-law relationship since the death of her spouse. As she is a Canadian citizen and has lived in Canada for more than 10 years since the age of 18, she may be eligible for the Allowance for the Survivor.

The Allowance for the Survivor is a benefit for individuals aged 60 to 64 who are widowed and living on a low income in Canada. Payment of the Allowance for the Survivor stops when the person receiving it reaches their 65th birthday (the age of eligibility for the OAS pension and the GIS).

To be eligible for the Allowance for the Survivor, you must:

To apply for the Allowance for the Survivor, go to Section 4.3

This section will help you estimate the amount you will receive if you are eligible for the OAS pension, the GIS and/or the Allowance benefits.

The benefit amounts tables show the maximum amounts you could receive. However, the amounts you receive depend on several things.

For the OAS pension, your benefit amount may be affected by:

Note: If your net annual income exceeds a certain amount ($86,912 for 2023), you may have to repay part of, or your entire OAS pension. Your OAS pension would be reduced as a monthly recovery tax.

The amount of GIS you receive depends on:

For the Allowance, the amount you receive depends on:

For the Allowance for the Survivor, the amount you receive depends on:

Note: The amounts may increase every 3 months (in January, April, July, and October) to protect you from increases in the cost of living.

Note: The GIS, Allowance, and Allowance for the Survivor are reassessed annually. Benefit amounts are based on your income and the income of your spouse or common-law partner for the last tax year, if applicable. If you or your spouse or common-law partner have retired or your pension income has been reduced, you may be able to provide an estimate of your reduced income to receive a higher benefit amount.

For additional details on OAS pension and Guaranteed income supplement amounts, go to Old Age Security payment amounts.

| Your situation | Maximum allowance benefit amount |

|---|---|

| Married/Living in a common-law relationship and your partner receives the full OAS pension and Guaranteed Income Supplement | $1,266.36 |

| Your situation | Maximum allowance the Survivor benefit amount |

|---|---|

| Married/Living in a common-law relationship and you are surviving spouse/common-law partner | $1,509.58 |

In this section:

This section will help you apply for the OAS pension and the GIS.

In some cases, Service Canada will be able to automatically enroll you for the OAS pension and the GIS. In other cases, you will have to apply. You will need to apply if:

If you did not receive any letter about the Old Age Security pension the month after you turned 64, contact us to find out if you need to apply.

You may need to provide documentation to support your application. Examples include:

Note: If you expect a long wait time to get your required documents (for example, if you need to contact your country of origin), it is recommended that you apply now, and send Service Canada your documents as soon as you receive them.

Jocelyne is 64 years old, a Canadian citizen, and has 40 years of Canada Pension Plan (CPP) contributions.

Jocelyne receives a letter from Service Canada notifying her that she will be automatically enrolled for the OAS pension the month after her 65th birthday. The letter includes the information Service Canada has used to determine Jocelyne's eligibility for OAS. The information is correct, so she does not need to contact Service Canada or complete an application form.

If you are 64 years old, live in Canada and have participated in the Canada Pension Plan and/or Quebec Pension Plan program for at least 40 years and/or have filed your taxes annually you may be automatically enrolled for the OAS pension.

If you qualify for automatic enrollment, you will be notified in writing before you turn 65. Service Canada will also tell you what information was used to determine your eligibility.

If this information is incorrect, you must make corrections in writing before your 65th birthday, as explained in the letter.

In some cases, Service Canada may ask you to complete an application form before your 65th birthday.

Note: If you are automatically enrolled for the OAS pension, Service Canada will also assess whether you are eligible for the GIS.

You have 2 options for applying for the OAS pension and GIS.

You have to apply separately for the GIS if:

Go to Section 4.3 to download the Application for the Guaranteed Income Supplement (ISP3025).

It is your responsibility to contact Service Canada if:

*If you and your spouse/common-law partner are no longer able to live together for reasons beyond your control, such as when one partner has to move into a nursing home or long-term care facility, you may be entitled to receive a higher benefit amount.

You can view and update your personal information online through My Service Canada Account. If you currently receive the OAS pension, or if your first OAS pension payment is pending, you can use My Service Canada Account to:

If you receive a letter notifying you that you will be automatically enrolled for the OAS pension and you do not wish to start receiving it, you can delay it through My Service Canada Account.

To access My Service Canada Account, go to Section 4.3.

For all other changes, contact Service Canada (refer to Section 4.1).

After you apply, Service Canada will contact you by mail once a decision has been made, or to request additional information or documents to process your application. If you apply 6 months or more in advance, Service Canada will try to ensure you receive your first payment the month after your 65th birthday.

If Service Canada asks you for more information, it is in your best interest to respond as soon as you can. This will ensure your application is processed as quickly as possible.

If you request to receive OAS (and, if applicable, the GIS) by direct deposit, payment will be made into your account on the last 3 banking days of each month. Otherwise, a cheque will be mailed to you during the last 3 banking days of each month.

If you are automatically enrolled for the OAS pension (and, if applicable, the GIS) and you currently receive a Canada Pension Plan benefit by direct deposit, your OAS pension will be deposited into the same account.

Your OAS pension can be paid outside of Canada if:

If you do not meet these requirements, you can only receive the OAS pension outside of Canada for up to 6 months. When you return to Canada, contact Service Canada in order to have your OAS payment resume.

If you leave Canada for more than 6 months, your GIS, Allowance or Allowance for the Survivor payment will be stopped no matter how long you previously lived in Canada. You must contact Service Canada once you return to live in Canada in order to determine eligibility to these benefits.

To authorize someone to communicate with Service Canada on your behalf, complete the Consent to Communicate Information to an Authorized Person form (ISP1603) form and mail it to Service Canada or bring it to your nearest Service Canada office. If you have a My Service Canada Account you can complete the form online. This form does not allow the person to apply for benefits on your behalf, change your payment address, or request/change the withholding of tax.

If you are not able to manage your own affairs, another person or agency (a trustee) may be appointed to act on your behalf.

To make changes on behalf of another person, you must submit a Certificate of Incapability (ISP3505), completed by a medical professional. You must also complete one of the following forms:

Please refer to Section 4.1 for Service Canada contact information and Section 4.3 for the link to the forms.

In this section:

To see if you may be eligible for other federal and provincial/territorial benefits, use the Canada Benefits Finder (go to Section 4.3). Answer a few simple questions and the Canada Benefits Finder will identify programs and services that you may be eligible for.

If you live or have lived or worked in another country, Canada's social security agreements with other countries may help you qualify for a foreign benefit. The terms of each agreement are different so you will need to contact Service Canada to find out more. Go to Section 4.3 for additional information about Canada's agreements with other countries.

If you have lived or worked in a country with which Canada has not signed an agreement, you must contact that country directly to find out if you qualify for a foreign benefit.

In this section:

To contact Service Canada in person, find your nearest Service Canada office in Section 4.3.

To contact us in writing, please mail forms/documents to your nearest office, which can be found using the link in the Section 4.3.

To contact Service Canada by phone from Canada or the United States:

Hours of operation: 8:30 am to 4:30 pm EST, Monday to Friday.

For more information, and to connect with Service Canada on social media:

Allowance A monthly benefit available to low-income individuals aged 60 to 64 whose spouse or common-law partner receives the GIS. Allowance for the Survivor A monthly benefit available to individuals aged 60 to 64 who have a low income, who are living in Canada, whose spouse or common-law partner has died, and who have not remarried or entered into a common-law relationship. Automatic Enrollment If you are 64 years old, live in Canada and have paid into the Canada Pension Plan or Quebec Pension Plan program for at least 40 years, you should be automatically enrolled with Service Canada for the OAS pension. Canada Benefits Finder An online tool that provides a customized list of federal and provincial or territorial programs and services for which you may be eligible. Canada Pension Plan (CPP) A mandatory public insurance plan that provides contributors and their families with partial replacement of earnings in the case of retirement, disability, or death. Residents of Quebec can refer to the Quebec Pension Plan (QPP). Certified copy A photocopy of a document that is certified by a Service Canada employee or another eligible person to be a true copy of the primary document. Common-law A common-law partner is someone who has been living with you in a conjugal relationship for at least 1 year. Foreign benefit A benefit from another country where you have lived or worked. Guaranteed Income Supplement (GIS) A monthly non-taxable benefit for OAS pension recipients who have a low income and are living in Canada. Legal status A Canadian citizen or person legally admitted into Canada as a permanent or temporary resident. If applying for an Old Age Security pension from outside the country, you must have been a Canadian citizen or legal resident when you left Canada. My Service Canada Account (MSCA) An online tool that allows you to view and update your Employment Insurance, Canada Pension Plan, and Old Age Security information online, and to submit electronic application forms for some benefits. Old Age Security (OAS) pension A monthly taxable benefit available to seniors aged 65 and older who meet the Canadian legal status and residence requirements. You can receive the OAS pension even if you have not worked in Canada. Quebec Pension Plan A mandatory public insurance plan for Quebec residents that provides contributors and their families with partial replacement of earnings in the case of retirement, disability, or death. Residence in Canada Periods when you normally live in Canada. Some absences from Canada may also be included, like periods of work outside Canada for a Canadian employer (such as the Canadian Armed Forces or an international charitable organization). Service Canada Provides Canadians with a single point of access to a wide range of government services and benefits. Service Canada gives Canadians access to a full range of Government services and benefits through the Internet, by telephone, in person or by mail. Social security agreement An agreement between Canada and another country to coordinate pension programs for people who have lived and/or worked in both countries.

This refers to residence in Canada, which includes periods when you normally live in the country. Some absences from Canada may be counted, like periods of work outside Canada for a Canadian employer (such as the Canadian Armed Forces or an international charitable organization).

Agreements Canada has signed with over 50 countries that can help people meet the residence requirements for OAS. Go to Section 4.3 for more information.

Canada has signed social security agreements with over 50 countries and the requirements vary from agreement to agreement. Please see the list of agreements.

A Canadian citizen or a person legally admitted into Canada as a permanent or temporary resident. If applying from outside Canada, you must have been a Canadian citizen or a legal resident when you left Canada.

Common-law refers to an unmarried couple who have lived together in a conjugal relationship for at least 1 year.

You are likely eligible for a full pension if you have lived in Canada all your life. You may be eligible for a partial pension if you have lived outside of Canada for any period after the age of 18.

To find out how to calculate your net annual income, go to Section 4.3. Do not include the amount you receive from your OAS basic pension in your calculation.

For more detail on the maximum net annual income amounts related to GIS eligibility, go to Section 4.3. These maximums may increase annually with the cost of living.

If you have not lived in Canada long enough, a social security agreement may help you to qualify (go to Section 1.2).

If you are receiving a partial pension, contact Service Canada for information on benefit amounts (go to Section 4.1 for contact information).